ICAI CA Syllabus & Subjects for Foundation, Inter & Final 2023 (PDF)

In this article, you’ll know the complete CA syllabus and subjects 2023 for all three levels: Foundation, Inter, and Final.

To give an overview, the CA Course will cover Accounting, Direct and Indirect taxes, Auditing, Corporate Law, Financial management and much more at an advanced level.

The CA Foundation is the first level and includes 4 subjects similar to what you studied in your 11th and 12th class. But, the CA Inter and Final syllabus is vast and has 8 subjects at each level.

ICAI is the governing body of the CA exams and releases the updated curriculum. On this page, we have provided the CA syllabus relevant for the 2023 exams. Students can also download the latest CA Syllabus pdf from this page below.

| Particular | Details |

| Course Name | Chartered accountant(CA) |

| Minimum eligibility | 10+2 qualification |

| Course Levels | Foundation, Inter & Final |

| Number of Levels |

|

| Difficulty Level | Average to Hard |

| CA Course Duration | 5 years |

| Conducting Body | ICAI |

The CA Course structure is as follows:

- CA Foundation Course

- CA Intermediate Course

- CA Final Course

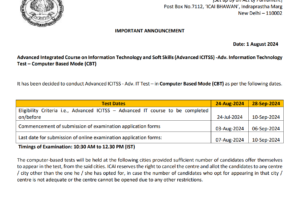

The ICAI has recently proposed the CA new scheme that might be applicable for the 2023 exams. In the new scheme, ICAI has made significant changes at all levels to make the CA Course at par with International standards.

Chartered Accountant Syllabus and Subjects 2023 PDF

Students can download the Chartered Accountant syllabus pdf for the 2023 exams.

| CA Subjects | CA Syllabus PDF |

| CA Foundation Syllabus | Download |

| CA Inter Syllabus | Download |

| CA Final Syllabus | Download |

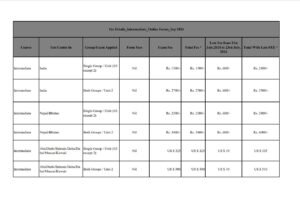

Students can also check the CA Course fee structure for Foundation, Intermediate and Final.

CA Foundation Syllabus 2023

CA Foundation syllabus includes four subjects. The candidate must have to clear all these four papers to qualify for the exam. The CA foundation syllabus 2023 PDF download is available on ICAI’s official site. The four subjects in the CA syllabus for the Foundation level are:

| CA Foundation Subjects | Marks |

|---|---|

| Principles and Practices of Accounting | 100 Marks |

Business Law & Business Correspondence and Reporting

|

100 Marks |

Business Mathematics and Logical Reasoning & Statistics

|

100 Marks |

| Business Economics & Business and Commercial Knowledge | 100 Marks |

CA Intermediate Syllabus 2023

The CA Intermediate syllabus carries 8 subjects. This level is divided into 2 groups. In the first group of the exam a candidate faces 4 papers and in the second group also faces 4 papers. To face the final terms , CA candidates must clear the intermediate level. As per the CA syllabus ICAI a student gets an 8-month duration to complete all these subjects.

| Paper | CA Intermediate Subjects | Marks |

|---|---|---|

| Paper 1 | Accounting | 100 Marks |

| Paper 2 | Corporate Laws & Other Laws

|

100 Marks |

| Paper 3 | Cost and Management Accounting | 100 Marks |

| Paper 4 | Taxation

|

100 Marks |

| Paper 5 | Advanced Accounting | 100 Marks |

| Paper 6 | Auditing and Assurance | 100 Marks |

| Paper 7 | Enterprise Information System & Strategic Management

|

100 Marks |

| Paper 8 | Financial Management & Economics for Finance

|

100 Marks |

CA Final Syllabus 2023

The ICAI provides the CA course syllabus to know about the subjects and topics for the exam. CA final exam is the last step towards Chartered Accountancy. If a candidate wishes to be a professional CA then he/she must have face all these three levels of exam. The final level exam of CA consists of 8 subjects. ICAI conducts this exam in two groups.

| Paper | CA Final Subjects | Marks |

|---|---|---|

| Paper 1 | Financial Reporting | 100 Marks |

| Paper 2 | Strategic Financial Management | 100 Marks |

| Paper 3 | Advanced Auditing and Professional Ethics | 100 Marks |

| Paper 4 | Corporate Laws and other Economic Laws | 100 Marks |

| Paper 5 | Strategic Cost Management and Performance Evaluation | 100 Marks |

| Paper 6 | Elective Paper | 100 Marks |

| Paper 7 | Direct Tax Laws | 100 Marks |

| Paper 8 | Indirect Tax Laws | 100 Marks |